Why Researchers Say Carbon-Intensive Stocks Are Overpriced

May 2, 2022

Table of Contents

According to research out of the University of Waterloo, the stock market overvalues most carbon-intensive companies, such as oil and coal producers. Climate change is rapidly limiting the potential of carbon-intensive industries. The effects on businesses are direct, such as property damaged by extreme weather, as well as indirect, perhaps through government intervention and regulation, and by conscious consumers.

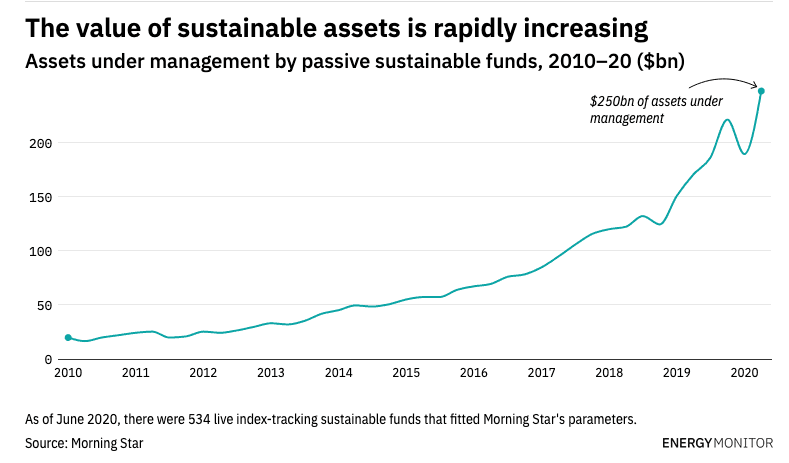

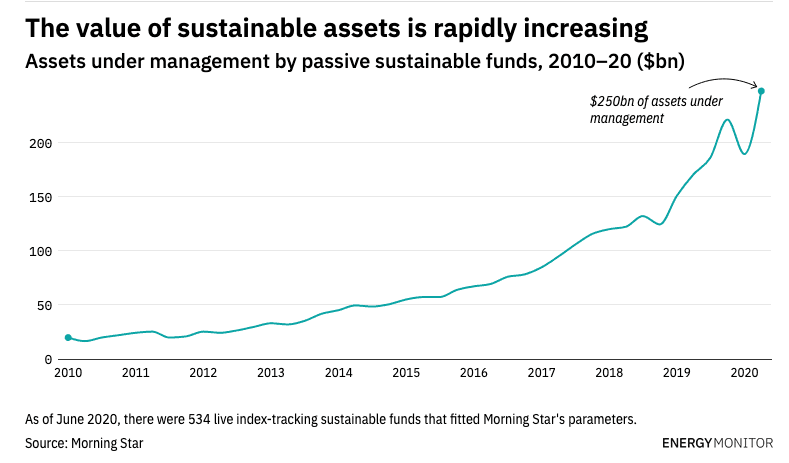

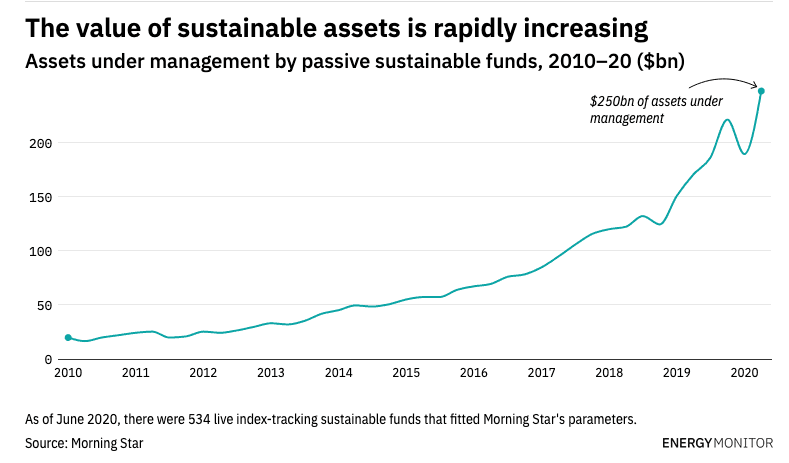

This is bad news for investors with carbon-heavy portfolios. Fears about future regulation and climate change are pushing people toward newer low-carbon technologies fast. Investors are already choosing green companies as opposed to carbon emitters. By 2020, the sustainable economy increased to $250 billion.

The Dangers of Climate Change for Stocks

In a study published in the Journal of Sustainable Finance & Investment, researchers from the University of Waterloo found that companies in carbon-intensive sectors are at significant risk from the effects of global warming.

The direct effects on physical assets have been common knowledge for some time. However, study author Mingyu Fang stated in a release to Eureka Alert that, "for the traditional energy sector, such devaluation will likely start from their oil reserves being stranded by stricter environmental regulations as part of a sustainable, global effort to mitigate the effects caused by climate change."

The two main effects of climate on stock prices

1. Direct impacts on physical assets

As oceans rise and weather becomes more extreme, the risk of property damage increases significantly, especially along the coasts. As climate change worsens, any company with extensive holdings in coastal areas is at risk of property losses.

For example, oil companies relying on refineries and rigs in the Gulf of Mexico will face more powerful hurricanes, longer hurricane seasons and higher storm surges.

2. Indirect effects through increased regulation

As climate change continues to cause problems, such as flooding, drought and extreme storms, people will finally demand tighter controls on carbon emissions. These might include set limits or more flexible carbon-pricing measures.

Canada and Europe are already well into preliminary efforts to make significant cuts to carbon emissions through carbon credit trading and taxes. According to researchers, as regulations increase, many reserves of oil, gas and coal now priced into company values may become impractical to exploit within 10 years.

In other words, the stock prices of many companies stand on the assumption that they eventually will mine or drill most of their energy reserves. However, as governments clamp down on carbon emissions, much of that oil, gas and coal may stay in the ground unused.

Carbon-Intensive Companies Already Overpriced

The "investment carbon risk" refers to a company's level of exposure to the two significant risks of climate change listed above. According to the University of Waterloo researchers, most carbon-intensive companies are already overpriced compared to the potential value loss resulting from climatic influences.

Increasing risks from climate change are no longer a problem that is decades away. For example, coal usage is already in steep decline in the United States. In 2005 it accounted for 50 percent of total power generation, but by 2015 that figure had dropped to only 33 percent.

Investors are now looking to get out of carbon-intensive industries. These may include well-established alternative energy industries such as solar and wind, electric cars and carbon capture projects.

Related content

If you would like to learn more about why investors are keeping their eyes on the green economy please read our related articles:

• Article: What Is Corporate Sustainability and How to Achieve It

• Article: GHG Reporting: Everything You Need to Know

Market Solutions to Climate Change

Picking low-carbon stocks no longer means you'll have an investment portfolio without profits. In fact, it's the opposite. Carbon is now a financial liability with new regulations and eco-friendly consumers that refuse to buy polluting products. Carbon-intensive industries are increasingly overpriced compared to their future potential.

Final takeaways

Investors are now shying away from carbon-intensive stocks. Now that ESG criteria is being heavily weighted by investors, CO2 reporting with accurate calculations and measurements is necessary to even get their attention or have them back you up. Net0 emissions management platform is the answer to gathering data you need to communicate your net zero efforts.

Book a free demo with Net0 and talk to an expert about how you can measure, track, reduce, offset, and report your emissions so you can get carbon-neutral certified and add value to the environment and your stocks.

According to research out of the University of Waterloo, the stock market overvalues most carbon-intensive companies, such as oil and coal producers. Climate change is rapidly limiting the potential of carbon-intensive industries. The effects on businesses are direct, such as property damaged by extreme weather, as well as indirect, perhaps through government intervention and regulation, and by conscious consumers.

This is bad news for investors with carbon-heavy portfolios. Fears about future regulation and climate change are pushing people toward newer low-carbon technologies fast. Investors are already choosing green companies as opposed to carbon emitters. By 2020, the sustainable economy increased to $250 billion.

The Dangers of Climate Change for Stocks

In a study published in the Journal of Sustainable Finance & Investment, researchers from the University of Waterloo found that companies in carbon-intensive sectors are at significant risk from the effects of global warming.

The direct effects on physical assets have been common knowledge for some time. However, study author Mingyu Fang stated in a release to Eureka Alert that, "for the traditional energy sector, such devaluation will likely start from their oil reserves being stranded by stricter environmental regulations as part of a sustainable, global effort to mitigate the effects caused by climate change."

The two main effects of climate on stock prices

1. Direct impacts on physical assets

As oceans rise and weather becomes more extreme, the risk of property damage increases significantly, especially along the coasts. As climate change worsens, any company with extensive holdings in coastal areas is at risk of property losses.

For example, oil companies relying on refineries and rigs in the Gulf of Mexico will face more powerful hurricanes, longer hurricane seasons and higher storm surges.

2. Indirect effects through increased regulation

As climate change continues to cause problems, such as flooding, drought and extreme storms, people will finally demand tighter controls on carbon emissions. These might include set limits or more flexible carbon-pricing measures.

Canada and Europe are already well into preliminary efforts to make significant cuts to carbon emissions through carbon credit trading and taxes. According to researchers, as regulations increase, many reserves of oil, gas and coal now priced into company values may become impractical to exploit within 10 years.

In other words, the stock prices of many companies stand on the assumption that they eventually will mine or drill most of their energy reserves. However, as governments clamp down on carbon emissions, much of that oil, gas and coal may stay in the ground unused.

Carbon-Intensive Companies Already Overpriced

The "investment carbon risk" refers to a company's level of exposure to the two significant risks of climate change listed above. According to the University of Waterloo researchers, most carbon-intensive companies are already overpriced compared to the potential value loss resulting from climatic influences.

Increasing risks from climate change are no longer a problem that is decades away. For example, coal usage is already in steep decline in the United States. In 2005 it accounted for 50 percent of total power generation, but by 2015 that figure had dropped to only 33 percent.

Investors are now looking to get out of carbon-intensive industries. These may include well-established alternative energy industries such as solar and wind, electric cars and carbon capture projects.

Related content

If you would like to learn more about why investors are keeping their eyes on the green economy please read our related articles:

• Article: What Is Corporate Sustainability and How to Achieve It

• Article: GHG Reporting: Everything You Need to Know

Market Solutions to Climate Change

Picking low-carbon stocks no longer means you'll have an investment portfolio without profits. In fact, it's the opposite. Carbon is now a financial liability with new regulations and eco-friendly consumers that refuse to buy polluting products. Carbon-intensive industries are increasingly overpriced compared to their future potential.

Final takeaways

Investors are now shying away from carbon-intensive stocks. Now that ESG criteria is being heavily weighted by investors, CO2 reporting with accurate calculations and measurements is necessary to even get their attention or have them back you up. Net0 emissions management platform is the answer to gathering data you need to communicate your net zero efforts.

Book a free demo with Net0 and talk to an expert about how you can measure, track, reduce, offset, and report your emissions so you can get carbon-neutral certified and add value to the environment and your stocks.

According to research out of the University of Waterloo, the stock market overvalues most carbon-intensive companies, such as oil and coal producers. Climate change is rapidly limiting the potential of carbon-intensive industries. The effects on businesses are direct, such as property damaged by extreme weather, as well as indirect, perhaps through government intervention and regulation, and by conscious consumers.

This is bad news for investors with carbon-heavy portfolios. Fears about future regulation and climate change are pushing people toward newer low-carbon technologies fast. Investors are already choosing green companies as opposed to carbon emitters. By 2020, the sustainable economy increased to $250 billion.

The Dangers of Climate Change for Stocks

In a study published in the Journal of Sustainable Finance & Investment, researchers from the University of Waterloo found that companies in carbon-intensive sectors are at significant risk from the effects of global warming.

The direct effects on physical assets have been common knowledge for some time. However, study author Mingyu Fang stated in a release to Eureka Alert that, "for the traditional energy sector, such devaluation will likely start from their oil reserves being stranded by stricter environmental regulations as part of a sustainable, global effort to mitigate the effects caused by climate change."

The two main effects of climate on stock prices

1. Direct impacts on physical assets

As oceans rise and weather becomes more extreme, the risk of property damage increases significantly, especially along the coasts. As climate change worsens, any company with extensive holdings in coastal areas is at risk of property losses.

For example, oil companies relying on refineries and rigs in the Gulf of Mexico will face more powerful hurricanes, longer hurricane seasons and higher storm surges.

2. Indirect effects through increased regulation

As climate change continues to cause problems, such as flooding, drought and extreme storms, people will finally demand tighter controls on carbon emissions. These might include set limits or more flexible carbon-pricing measures.

Canada and Europe are already well into preliminary efforts to make significant cuts to carbon emissions through carbon credit trading and taxes. According to researchers, as regulations increase, many reserves of oil, gas and coal now priced into company values may become impractical to exploit within 10 years.

In other words, the stock prices of many companies stand on the assumption that they eventually will mine or drill most of their energy reserves. However, as governments clamp down on carbon emissions, much of that oil, gas and coal may stay in the ground unused.

Carbon-Intensive Companies Already Overpriced

The "investment carbon risk" refers to a company's level of exposure to the two significant risks of climate change listed above. According to the University of Waterloo researchers, most carbon-intensive companies are already overpriced compared to the potential value loss resulting from climatic influences.

Increasing risks from climate change are no longer a problem that is decades away. For example, coal usage is already in steep decline in the United States. In 2005 it accounted for 50 percent of total power generation, but by 2015 that figure had dropped to only 33 percent.

Investors are now looking to get out of carbon-intensive industries. These may include well-established alternative energy industries such as solar and wind, electric cars and carbon capture projects.

Related content

If you would like to learn more about why investors are keeping their eyes on the green economy please read our related articles:

• Article: What Is Corporate Sustainability and How to Achieve It

• Article: GHG Reporting: Everything You Need to Know

Market Solutions to Climate Change

Picking low-carbon stocks no longer means you'll have an investment portfolio without profits. In fact, it's the opposite. Carbon is now a financial liability with new regulations and eco-friendly consumers that refuse to buy polluting products. Carbon-intensive industries are increasingly overpriced compared to their future potential.

Final takeaways

Investors are now shying away from carbon-intensive stocks. Now that ESG criteria is being heavily weighted by investors, CO2 reporting with accurate calculations and measurements is necessary to even get their attention or have them back you up. Net0 emissions management platform is the answer to gathering data you need to communicate your net zero efforts.

Book a free demo with Net0 and talk to an expert about how you can measure, track, reduce, offset, and report your emissions so you can get carbon-neutral certified and add value to the environment and your stocks.

Written by

Sofia Fominova

As Co-Founder of Net0, Sofia Fominova helps enterprises and governments leverage AI and data to achieve their sustainability goals. With over 60 AI-powered solutions, Net0 provides end-to-end sustainability tools—covering everything from automated data collection and full carbon management to industry-specific solutions for waste, water, and beyond. By addressing sustainability at every level, Net0 enables organizations to drive efficiency, reduce environmental impact, and create lasting change.

Reimagine Sustainability

with AI

Capitalize on the economic opportunities of sustainability with Net0's emissions management software.

Reimagine Sustainability

with AI

Capitalize on the economic opportunities of sustainability with Net0's emissions management software.

Reimagine Sustainability

with AI

Capitalize on the economic opportunities of sustainability with Net0's emissions management software.

Reimagine Sustainability

with AI

Capitalize on the economic opportunities of sustainability with Net0's emissions management software.